RFC-0001/Overview

Overview of Tari Network

Maintainer(s): Cayle Sharrock

Licence

Copyright 2018 The Tari Development Community

Redistribution and use in source and binary forms, with or without modification, are permitted provided that the following conditions are met:

- Redistributions of this document must retain the above copyright notice, this list of conditions and the following disclaimer.

- Redistributions in binary form must reproduce the above copyright notice, this list of conditions and the following disclaimer in the documentation and/or other materials provided with the distribution.

- Neither the name of the copyright holder nor the names of its contributors may be used to endorse or promote products derived from this software without specific prior written permission.

THIS DOCUMENT IS PROVIDED BY THE COPYRIGHT HOLDERS AND CONTRIBUTORS "AS IS", AND ANY EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, THE IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE ARE DISCLAIMED. IN NO EVENT SHALL THE COPYRIGHT HOLDER OR CONTRIBUTORS BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL, EXEMPLARY OR CONSEQUENTIAL DAMAGES (INCLUDING, BUT NOT LIMITED TO, PROCUREMENT OF SUBSTITUTE GOODS OR SERVICES; LOSS OF USE, DATA OR PROFITS; OR BUSINESS INTERRUPTION) HOWEVER CAUSED AND ON ANY THEORY OF LIABILITY, WHETHER IN CONTRACT, STRICT LIABILITY OR TORT (INCLUDING NEGLIGENCE OR OTHERWISE) ARISING IN ANY WAY OUT OF THE USE OF THIS SOFTWARE, EVEN IF ADVISED OF THE POSSIBILITY OF SUCH DAMAGE.

Language

The keywords "MUST", "MUST NOT", "REQUIRED", "SHALL", "SHALL NOT", "SHOULD", "SHOULD NOT", "RECOMMENDED", "NOT RECOMMENDED", "MAY" and "OPTIONAL" in this document are to be interpreted as described in BCP 14 (covering RFC2119 and RFC8174) when, and only when, they appear in all capitals, as shown here.

Disclaimer

This document and its content are intended for information purposes only and may be subject to change or update without notice.

This document may include preliminary concepts that may or may not be in the process of being developed by the Tari community. The release of this document is intended solely for review and discussion by the community of the technological merits of the potential system outlined herein.

Goals

The aim of this proposal is to provide a very high-level perspective of the moving parts of the Tari protocol.

Related Requests for Comment

Description

Abstract

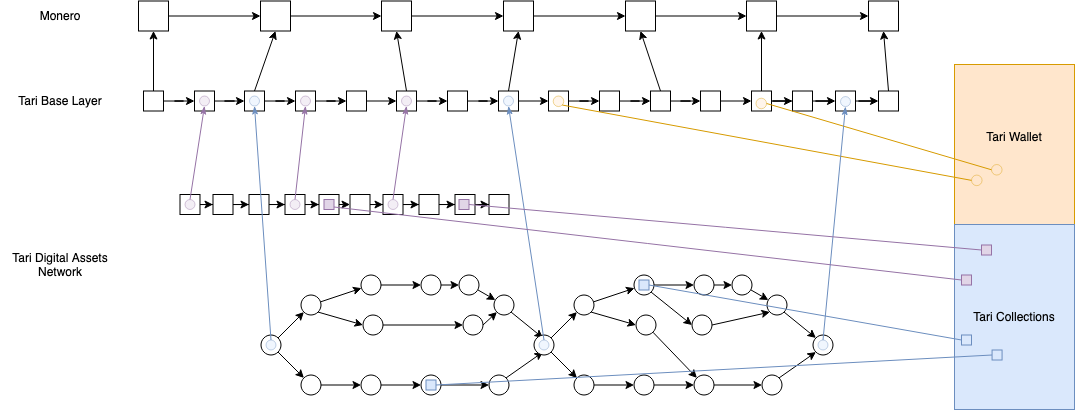

The Tari network comprises two layers:

- A base layer that deals with Tari coin transactions. It governed by a proof-of-work (PoW) blockchain that is merged-mined with Monero. The base layer is highly secure, decentralized and relatively slow.

- A digital assets network (DAN), consisting of multiple independent sidechains, that manage the state of the native digital assets. It is built for liveness, speed and scalability at the expense of decentralization.

Currency Tokens and Digital Assets

There are two major digital entities on the Tari network: the coins that are the unit of transfer for the Tari cryptocurrency, and the digital assets that could represent anything from tickets to in-game items.

Tari coins are the fuel that drives the entire Tari ecosystem. They share many of the properties of money, so security is a non-negotiable requirement. In a cryptocurrency context, this is usually achieved by employing a decentralized network running a censorship-resistant protocol such as Nakamoto consensus over a proof-of-work blockchain. As we know, PoW blockchains are not scalable or very fast.

On the other hand, the Tari network will be used to create and manage digital assets.

In Tari parlance, a digital asset is defined as a finite set of digital stateful tokens that are governed by predefined rules. A single digital asset may define anything from one to thousands of tokens within its scope.

For example, in a ticketing context, an event will be an asset. The asset definition will allocate tokens representing the tickets for that event. The ticket tokens will have state, such as its current owner and whether or not it has been redeemed. Users might be interacting with digital assets hundreds of times a second, and state updates need to be propagated and agreed upon by the network very quickly. A blockchain-enabled ticketing system is practically useless if a user has to wait for "three block confirmations" before the bouncer will let her into a venue. Users expect near-instant state updates because centralized solutions offer them that today.

Therefore the Tari DAN must offer speed and scalability.

Multiple Layers

The distributed system trilemma tells us that these requirements are mutually exclusive.

We can't have fast, cheap digital assets and also highly secure and decentralized currency tokens on a single system.

Tari overcomes this constraint by building two layers:

- A base layer that provides a public ledger of Tari coin transactions, secured by PoW to maximize security.

- A DAN consisting of multiple independent sidechains that each manage the state of a digital asset. It is very fast and cheap, at the expense of decentralization.

If required, the digital assets layer can refer back to the base layer to temporarily give up speed in exchange for increased security. These commitments allow token owners to make attestations based on their asset state without relying completely on the sidechain infrastructure. Furthermore, this link to the base layer can be used to resolve consensus issues on the digital assets layer that may crop up from time to time as a result of the lower degree of decentralization.

Base Layer

Refer to RFC-0100/BaseLayer for more detail.

The Tari base layer has the following primary features:

- PoW-based blockchain using Nakamoto consensus

- Transactions and blocks based on the Mimblewimble protocol

Mimblewimble is an exciting new blockchain protocol that offers some key advantages over other UTXO-based cryptocurrencies such as Bitcoin:

- Transactions are private. This means that casual observers cannot ascertain the amounts being transferred or the identities of the parties involved.

- Mimblewimble employs a novel blockchain "compression" method called cut-through, which dramatically reduces the storage requirements for blockchain nodes.

- Multi-signature transactions can be easily aggregated, making such transactions very compact, and completely hiding the parties involved, or the fact that there were multiple parties involved at all.

"Mimblewimble is the most sound, scalable 'base layer' protocol we know" -- @fluffypony

Proof of Work

There are a few options for the PoW mechanism for Tari:

- Implement an existing PoW mechanism. This is a bad idea, because a nascent cryptocurrency that uses a non-unique mining algorithm is incredibly vulnerable to a 51% attack from miners from other currencies using the same algorithm. Bitcoin Gold and Verge have already experienced this, and it's a matter of time before it happens to others.

- Implement a unique PoW algorithm. This is a risky approach and comes close to breaking the number one rule of cryptocurrency design: never roll your own crypto.

- Merged mining. This approach is not without its own risks, but offers the best trade-offs in terms of bootstrapping the network. It typically provides high levels of hash rate from day one, along with 51% attack resistance, assuming mining pools are well-distributed.

- A hybrid approach, utilizing two or more of the above mechanisms.

Given Tari's relationship with Monero, a merged-mining strategy with Monero makes the most sense. However, the PoW mechanism SHOULD be written in a way that makes it relatively easy to code, implement and switch to a different strategy in the future. More information on Tari's current approach can be found in RFC-0131_Mining.

The mining strategy is explained more thoroughly in RFC-130.

Digital Assets Network

A more detailed proposal for the DAN is presented in RFC-0300/DAN. Digital assets are discussed in more detail in RFC-0310/Assets.

The DAN is focused on achieving high speed and scalability, without compromising on security. To achieve this we make the explicit trade-off of sacrificing decentralization. Generally, the primary parties that have a stake in the security of a given digital asset are the Asset Issuer and Token owners. This fact points to a natural centralization of control of an asset by the Asset Issuer.

Digital Assets consist of a set of tokens and their associated state. The state of an asset's tokens will be managed on a sidechain that will run in parallel to the Tari base layer. The consensus mechanism, ledger style and other characteristics of the sidechain will be chosen and managed by the Asset Issuer.

There are many options for the nature of these sidechains. These are still under discussion but it will be possible to run multiple types of sidechains in the DAN and an Asset Issuer can choose which best suits the asset type it is supporting.

Please refer to Tari Labs University (TLU) for detailed discussions on layer 2 scaling solutions and consensus mechanisms.

Interaction between Base Layer and Digital Assets Network

The base layer provides supporting services to the DAN. In general, the base layer only knows about Tari coin transactions. It knows nothing about the details of any digital assets and their state.

This is by design: the network cannot scale if details of digital asset contracts have to be tracked on the base layer. We envisage that there could be tens of thousands of contracts deployed on Tari. Some of those contracts may be enormous; imagine controlling every piece of inventory and their live statistics for a massively multiplayer online role-playing game (MMORPG). The base layer is also too slow. If any state relies on base layer transactions being confirmed, there is an immediate lag before that state change can be considered final, which kills the liveness properties we seek for the DAN.

It is better to keep the two networks almost totally decoupled from the outset, and allow each network to play to its strength.

That said, there are key interactions between the two layers. The base layer is a ledger and can be used as a source of truth for the DAN. Asset sidechains will periodically commit to their state on the base layer. These commitments make it possible for token owners to make attestations about their tokens at certain points in time without relying on the sidechain. These commitments can also be used as a final court of appeal in the case of consensus disputes.

The interplay between base layer and DAN is what incentivizes every actor in the system to maintain an efficient and well-functioning network, even while acting in their own self-interest.

Summary

The following table summarizes the defining characteristics of the Tari network layers:

| Base Layer | Digital Assets Network | |

|---|---|---|

| Speed | Slow | Fast |

| Scalability | Moderate | Very high |

| Security | High | Moderate |

| Decentralization | High | Low - Med |

| Processes digital asset instructions | Only checkpoints | Yes |